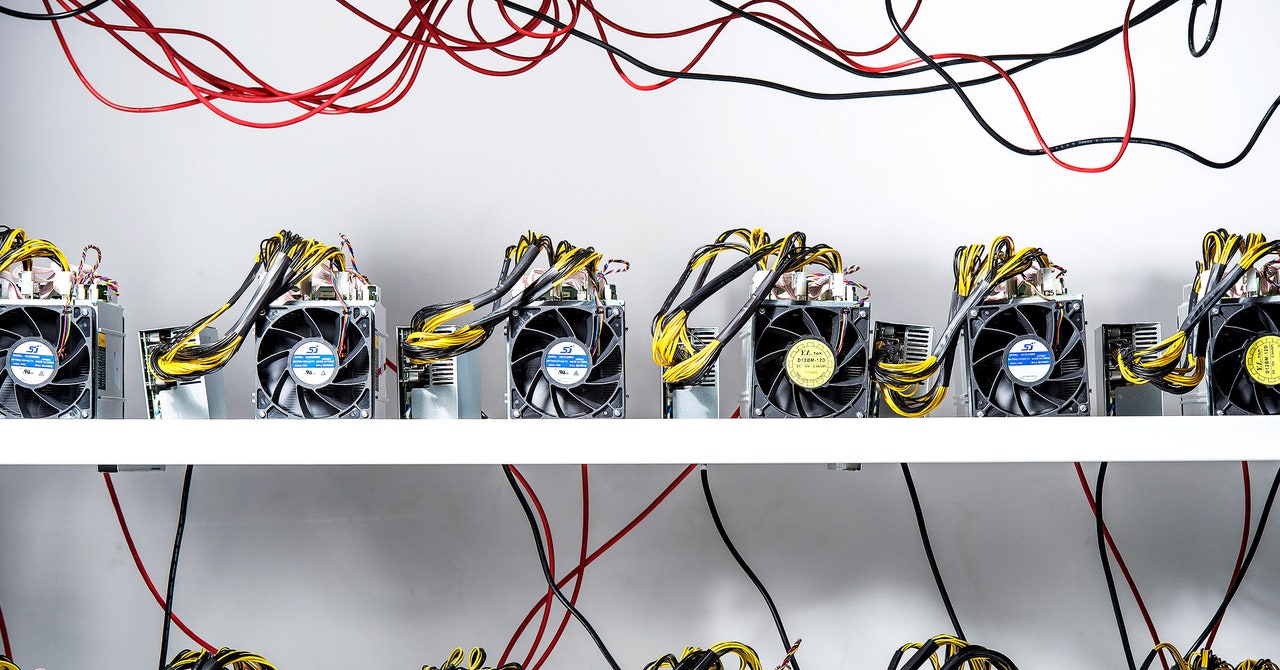

+++lead-in-textnnCryptocurrencies are often criticized for being bad for the planet.Every year, bitcoin mining [consumes more energy than Belgium](https://ccaf.io/cbeci/index/comparisons), according to the University of Cambridge’s Bitcoin Electricity Consumption Index.Ethereum’s consumption is usually pegged at roughly a third of Bitcoin’s, [even if estimates vary.](https://digiconomist.net/ethereum-energy-consumption/) Although some 39 percent of the energy going into bitcoin mining comes from renewable sources, [according to a 2020 Cambridge report,](https://www.jbs.cam.ac.uk/faculty-research/centres/alternative-finance/publications/3rd-global-cryptoasset-benchmarking-study/) the industry’s carbon footprint is generally regarded as unacceptable.According [to a 2019 study](https://www.reuters.com/technology/how-big-is-bitcoins-carbon-footprint-2021-05-13/), bitcoin mining belches out between 22 and 22.9 million metric tons of CO~2~ every year.nn+++nnThe problem is that specialized computers powered by eye-popping amounts of electricity are needed to process and verify transactions of cryptocurrencies like bitcoin or Ethereum’s ether on blockchains, via a process called proof-of-work mining.In this system, thousands of computers all over the world (but mostly in the US, China, Kazakhstan, and Russia) vie with each other to solve a mathematical puzzle and earn the privilege of appending a batch of transactions, or “block,” to the ledger.The miner who prevails wins a crypto reward.nnMost Bitcoin advocates will tell you that proof-of-work mining is essential to keep the network secure, and would never dream of tampering with something first conceived by the currency’s pseudonymous creator, Satoshi Nakamoto.But Ethereum is on the verge of a monumental change that will substantially reduce its environmental impact.nnEthereum, launched in 2015 by a 21-year-old whiz kid named Vitalik Buterin, is about to swap proof-of-work mining for an alternative system known as proof of stake, which does not require energy-guzzling computers.The Ethereum Foundation, a research nonprofit that spearheads updates and ameliorations to the Ethereum blockchain, [says the shift](https://ethereum.org/en/upgrades/merge/) will reduce the network’s energy consumption by 99.5 percent.

+++lead-in-textnnCryptocurrencies are often criticized for being bad for the planet.Every year, bitcoin mining [consumes more energy than Belgium](https://ccaf.io/cbeci/index/comparisons), according to the University of Cambridge’s Bitcoin Electricity Consumption Index.Ethereum’s consumption is usually pegged at roughly a third of Bitcoin’s, [even if estimates vary.](https://digiconomist.net/ethereum-energy-consumption/) Although some 39 percent of the energy going into bitcoin mining comes from renewable sources, [according to a 2020 Cambridge report,](https://www.jbs.cam.ac.uk/faculty-research/centres/alternative-finance/publications/3rd-global-cryptoasset-benchmarking-study/) the industry’s carbon footprint is generally regarded as unacceptable.According [to a 2019 study](https://www.reuters.com/technology/how-big-is-bitcoins-carbon-footprint-2021-05-13/), bitcoin mining belches out between 22 and 22.9 million metric tons of CO~2~ every year.nn+++nnThe problem is that specialized computers powered by eye-popping amounts of electricity are needed to process and verify transactions of cryptocurrencies like bitcoin or Ethereum’s ether on blockchains, via a process called proof-of-work mining.In this system, thousands of computers all over the world (but mostly in the US, China, Kazakhstan, and Russia) vie with each other to solve a mathematical puzzle and earn the privilege of appending a batch of transactions, or “block,” to the ledger.The miner who prevails wins a crypto reward.nnMost Bitcoin advocates will tell you that proof-of-work mining is essential to keep the network secure, and would never dream of tampering with something first conceived by the currency’s pseudonymous creator, Satoshi Nakamoto.But Ethereum is on the verge of a monumental change that will substantially reduce its environmental impact.nnEthereum, launched in 2015 by a 21-year-old whiz kid named Vitalik Buterin, is about to swap proof-of-work mining for an alternative system known as proof of stake, which does not require energy-guzzling computers.The Ethereum Foundation, a research nonprofit that spearheads updates and ameliorations to the Ethereum blockchain, [says the shift](https://ethereum.org/en/upgrades/merge/) will reduce the network’s energy consumption by 99.5 percent.

The big switcheroo is known as the Merge—and it is [slated to take place on September 14.](https://ultrasound.money/) nn### What Is the Merge?nThe Merge hinges on the fusion of Ethereum’s current proof-of-work blockchain with the Beacon Chain, a proof-of-stake blockchain that was [launched in December 2020](https://ethereum.org/en/upgrades/beacon-chain/) but so far has not processed any transactions.nnA couple of upgrades, scheduled to launch over the next few weeks, will lay the groundwork for a segue from one chain to the other.Justin Drake, a researcher at the Ethereum Foundation, says the way the process has been structured can be compared to a car switching from an internal combustion engine to an electric one.“How do we do that? Step one: We install an electric engine in parallel to the gasoline engine.And then—step two—we connect the wheels to the electric engine and turn off the gasoline engine.

That’s exactly what’s going to be happening at the Merge,” Drake says.“We’ve had this parallel engine of the Beacon Chain for a year and a half—and now the old ‘gasoline’ proof-of-work engine is going to be shut off.”nnAfter years of delays, the Ethereum community is positive that the long-awaited shift will finally happen, following a [successful dry run carried out on a test blockchain](https://www.cnbc.com/2022/08/10/ethereum-goerli-testnet-merge-goes-live-before-move-to-proof-of-stake.html), called the Goerli chain, on August 10.The fact that Buterin has a book titled *Proof of Stake* coming out in September is probably a coincidence.nn### How Will Ethereum’s Proof of Stake Work?nTalking about proof of stake is a bit like talking about French cheese: There are myriad varieties—with hundreds of cryptocurrencies claiming to use some version of the process.At its most basic, however, proof of stake is predicated on the idea of securing a network through incentives rather than hardware.nnIn this scenario, you don’t need an expensive mining computer to partake in the network: You can use your laptop to put down a “stake”—a certain amount of cryptocurrency locked in the network.

That gives you the chance of being selected, usually via a random process, to validate a certain block and earn crypto rewards and fees.If you try to game the system, for instance by doctoring a block, the network will punish you and destroy, or “slash,” some or all of your stake.nnThis is very different from proof-of-work mining’s function in a blockchain ecosystem, which is making sure no one can tamper with its chronology.

If a malicious actor wanted to rewrite history and, for instance, show that a certain cryptocurrency transaction never took place, they would have to re-mine the whole chain.To try to do so they’d have to amass computing power and electricity equivalent to more than half of the network’s miners— a type of exploit aptly called a “51% attack.”nnIn Ethereum’s specific case, stakers have to deposit at least 32 ethers ($58,722, as of August 17) in order to become validators, and they risk being fined if they are sloppy or losing all they have if they are dishonest.

Drake summarizes this by saying Ethereum’s proof of stake is “stick-heavy”—that is, penalty-based—rather than “carrot-heavy,” or reward-based.

“The stick turns out to be 100 times more powerful than the carrot,” he says.“And the reason is very simple: You can only afford to give a 1 percent reward to validators, because otherwise there would be too many ether tokens issued to reward them.But you can slash 100 percent of their ether if they start misbehaving.”nnThis architecture, Drake says, also makes the network harder to manipulate with a 51% attack.In order to corrupt the chain, he says, an attacker would have to stake an amount of ether equal to more than half of Ethereum’s staked ether, a sum he says is currently around $25 billion.“They can rewrite history—but it’s a one-time attack.And in the process, they will get slashed and lose their $25 billion.The second time they want to attack, they’ll have to spend $25 billion again.” That, Drake says, is more costly than a hardware-and-power-based attack on proof-of-work Ethereum, which he estimates could cost around $5 billion.nnFor that assumption to hold true, of course, the value of ether will have to remain fairly high throughout the years.

Were it to crash to negligible levels, attacking the network would become less expensive.“The amount of security is highly, highly correlated with the price of ether,” Drake says.

But he is confident that, post-Merge, ether’s value will substantially increase.Indeed, since the Goerli test, ether’s price is rallying.nn### Why Is It Important?nEthereum is different from Bitcoin in that, while the latter is mostly about payments, the former allows for the creation of blockchain-based applications and so-called smart contracts, which are self-enforcing subroutines powered by ether tokens.

Following the Merge, not much will change in terms of the apps that can be built on Ethereum, Drake says.nnBut the Merge will open the door to another process, called “sharding,” which will segment the network into many parallel chains.This, Drake says, will unclog the network, which currently supports only about 30 transactions per second and charges users extortionate transaction fees.If everything goes to plan, according to the Ethereum Foundation, a sharded Ethereum should [eventually reach a throughput of 100,000 per second](https://ethereum.org/en/upgrades/sharding/#:~:text=Sharding%20is%20the%20process%20of,rollups%20over%20the%20entire%20network.).nnA more pragmatic reason to celebrate the shift is simply the reduction in energy consumption.nn“Ethereum has almost doubled in value since its low [in June 2022] in expectation of the much-anticipated Merge, but no products or services built on the blockchain will change materially,” says Frank Muci, policy fellow at the Growth Lab Research Collaboration at the London School of Economics.

“The main change [will be] the reduced environmental footprint, which may reduce the reputational price of using the Ethereum database and the products and services built on it.”nn### What Are Miners Going to Do?nEthereum miners stand to lose the most from the Merge, as all the computers and energy contracts they use to generate their income (in ether rewards) will suddenly become useless.

Some of them are reportedly working to “fork” the blockchain—that is, to split the chain into a separate network that will not enact the proof-of-stake shift and will allow them to continue mining.Chandler Guo, a miner and blockchain entrepreneur who has been promoting the fork, [told CoinDesk that he floated the idea](https://www.youtube.com/watch?v=wefHLHKl4fw&t=46s) after many miners called him worried about “shutting down their business.”nnJustin Sun, the founder of proof-of-stake blockchain Tron and the owner of crypto exchange Poloniex, has announced that he will list a hypothetical proof-of-work ether token on his exchange post-Merge.“I am very excited about the Merge,” Sun says.“[But] nearly 50 percent of members from the community think proof-of-work is safer and even more decentralized than proof-of-stake.Therefore, I think proof-of-work is still essential to build the Ethereum infrastructure, as well as the community.”nnEthereum has undergone forks before: A split known as Ethereum Classic, also supported by Guo, was created in 2016 following a dispute over the [hack of an Ethereum-based entity called The DAO](https://www.coindesk.com/learn/2016/06/25/understanding-the-dao-attack/).Ethereum Classic, which will also keep operating as a proof-of-work network post-Merge, has become notorious for being the target of several successful 51% attacks since its inception.nnDrake says that while forks are reasonable and by definition allowed in a decentralized blockchain industry, he does not think they have “much legitimacy.”nn“There’s a very, very strong consensus within different communities that we do want to move to proof of stake,” he says.

“This upgrade is not at all contentious.” He points out that most decentralized finance protocols and stablecoins (a kind of crypto assets that can be redeemed for state-issued currencies) have already voiced their support for the Merge and will not be providing services to a hypothetical continuity proof-of-work chain—which would therefore risk becoming a semi-deserted blockchain for which not many apps are available.nnSun says that if a fork happens, he “will donate some forked token to the community and developers to build the Ethereum ecosystem” and organize hackathons to encourage the development of a proof-of-work Ethereum ecosystem.nn### Will Bitcoin Follow Suit?nDon’t bet on it.First of all, most bitcoiners think proof-of-work mining is more secure than proof-of-stake alternatives because it has been battle-tested.But more fundamentally, Bitcoin is inspired by a much more conservative ethos, and users—as well as the miners, many of which are publicly listed companies—are loath to tweak the rules laid down by Nakamoto back in 2008.nnWhile it is reasonable to expect miners to embrace renewables more over time, especially as regulators bear down on them, proof-of-work mining is likely to remain a central tenet of the Bitcoin ecosystem for the foreseeable future.nn.