Bitcoin BTC and cryptocurrencies have rocketed higher over recent months— causing the Biden administration to declare a crypto “emergency” —with ethereum up 50% and XRP XRP up 35% over the last year.

Bitcoin BTC and cryptocurrencies have rocketed higher over recent months— causing the Biden administration to declare a crypto “emergency” —with ethereum up 50% and XRP XRP up 35% over the last year.

Subscribe now to Forbes’ CryptoAsset & Blockchain Advisor and “uncover blockchain blockbusters poised for 1,000% plus gains” ahead of next year’s historical bitcoin halving!

The bitcoin price has topped $50,000 per bitcoin, making bitcoin a $1 trillion asset again and the pushing the wider ethereum, XRP and crypto market over $2 trillion ( with some claiming “this time is different” thanks to a looming earthquake ).

Now, as a leak revealed a controversial central bank digital dollar could be closer than thought , Wall Street giant JPMorgan has suddenly changed its tune on bitcoin and crypto exchange Coinbase thanks to the arrival of institutional “fomo.”

Bitcoin’s historical halving that’s expected to cause crypto price chaos is just around the corner! Sign up now for the free CryptoCodex — A daily newsletter for traders, investors and the crypto-curious that will keep you ahead of the market

MORE FROM FORBES Bitcoin Price Now Braced For A Surprise $6.9 Trillion Earthquake By Billy Bambrough MORE FOR YOU As The Ukrainians Fling 50,000 Drones A Month, The Russians Can’t Get Their Drone-Jammers To Work WWE SmackDown Results: Winners And Grades As The Rock And Roman Return Real Madrid Has Already Given Kylian Mbappé This Iconic Shirt Number, Reports OK Diario

“We think this bitcoin appreciation is contributing to better spot bitcoin ETF [exchange-traded funds] flows, which is in turn driving bitcoin prices higher, and pulling other tokens higher as well,” JPMorgan analysts led by Kenneth Worthington wrote in a note to clients seen by Coindesk .

The arrival of a long-awaited fleet of spot bitcoin ETFs on Wall Street last month has caused a 25% increase in the bitcoin price as asset managers led by Blackrock and Fidelity amass huge numbers of bitcoin.

This week, the nine new bitcoin ETFs saw inflows of around $630 million in just one day, taking their total to over $10 billion in assets under management.

“Given the acceleration in recent days of flows into bitcoin ETFs and the significant price appreciation of bitcoin and now ethereum ETH , we are returning to a ‘neutral’ rating on Coinbase as we see the higher cryptocurrency prices not only sustaining, but improving, activity levels and Coinbase’s earnings power as we look to [the first quarter of 2024],” JPMorgan analysts led by Kenneth Worthington wrote in a note to clients seen by Coindesk .

Coinbase, which is serving as the bitcoin custodian for the lion’s share of bitcoin ETFs, has seen its share price increase by just over 400% since hitting an all-time low in January 2023.

Sign up now for CryptoCodex —A free, daily newsletter for the crypto-curious

MORE FROM FORBES Bitcoin Price Suddenly Surges To Fresh 2024 High After PayPal Billionaire’s Huge Secret Bitcoin And Ethereum Bet Revealed By Billy Bambrough

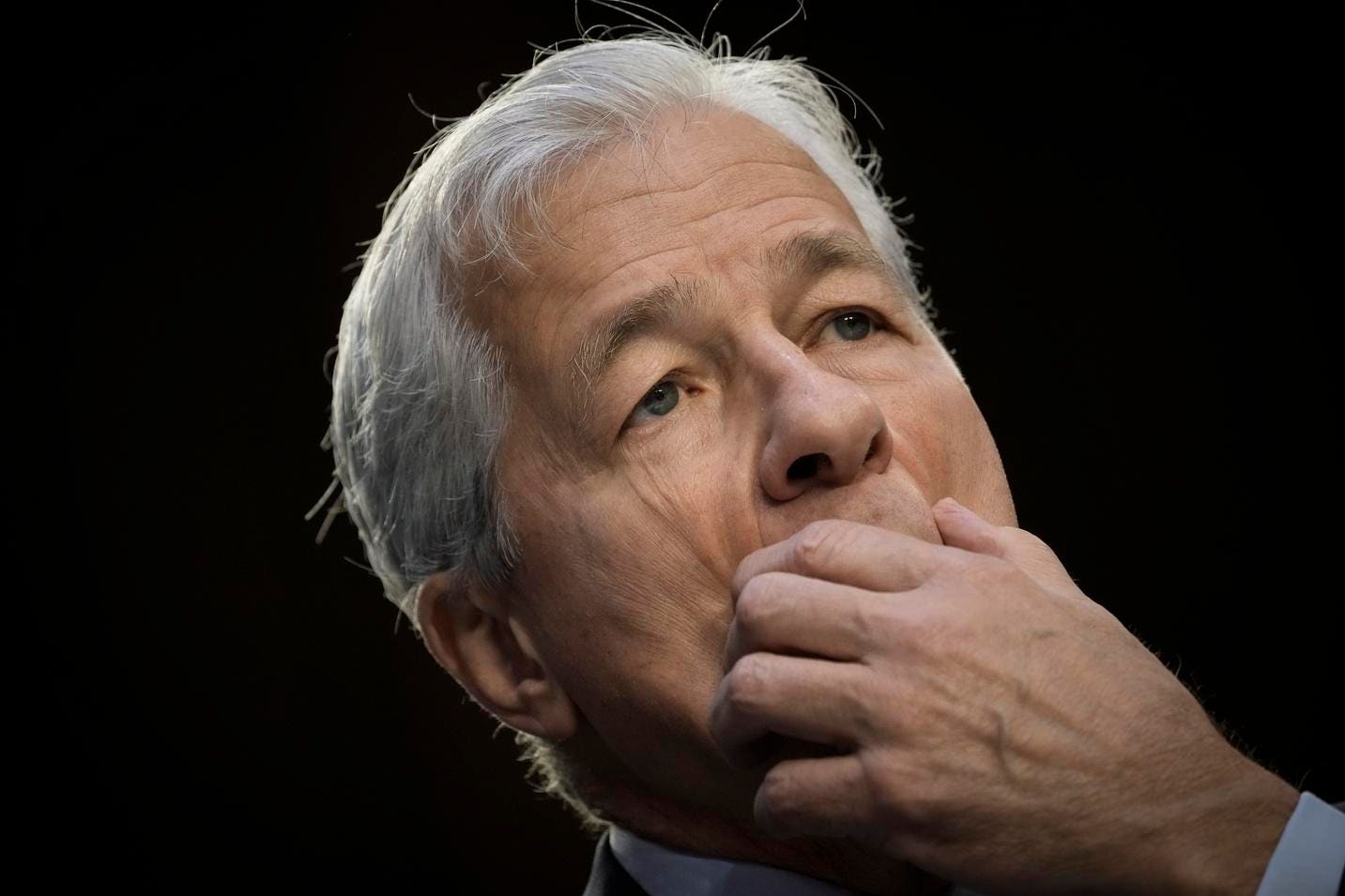

Despite JPMogan’s analysts raising their outlook for Coinbase, the bank’s chief executive Jamie Dimon remains a steadfast bitcoin and crypto skeptic, recently predicting bitcoin’s mysterious creator Satoshi Nakamoto could actually destroy the technology .

“I think there’s a good chance that …when we get to that 21 million bitcoins, [Satoshi Nakamato] is going to come on there, laugh hysterically, go quiet, and all bitcoin is going to be erased,” Dimon, who also said he’s done talking about bitcoin, told CNBC on the sidelines of the World Economic Forum (WEF) in Davos.

Billy Bambrough.